- 29 August 2016

- Michael McGrath

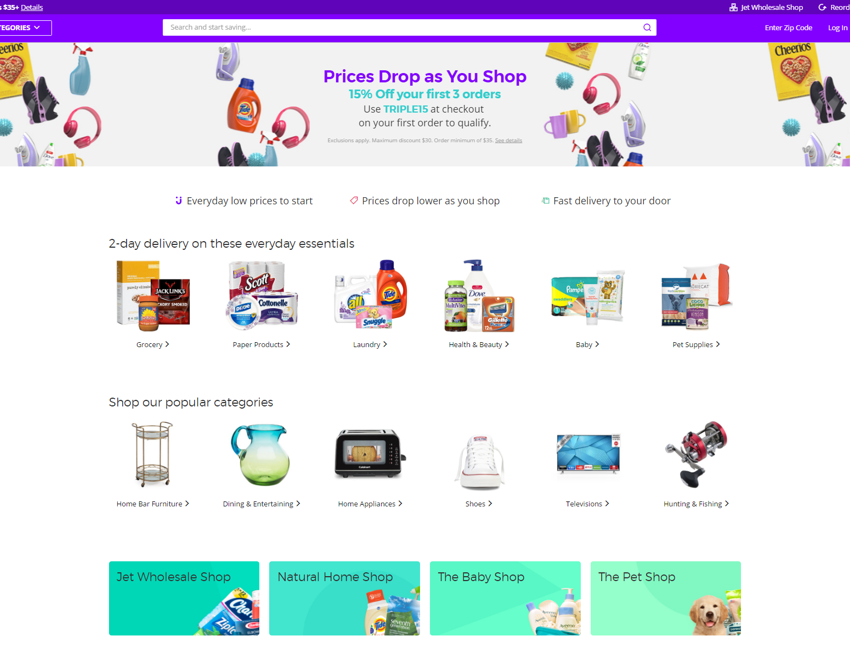

Wal-Mart acquires the year-old Jet.com for $US3.3b

Larger, more traditional businesses offer the potential for significant capital, distribution and scale to smaller, more agile businesses who bring smarts and IP.

As seen this month with Wal-Mart’s record-setting $US3.3b acquisition of the year-old e-commerce retailer Jet.com, large players are not put off by the infancy of a business and are paying for opportunity, expertise and innovation.

Wal-Mart’s valuation was driven by their need for smart management to improve slow growth in e-commerce sales, and in particular, the skills of digital entrepreneur and jet.com founder Marc Lore. It serves as an admission that all the money in the world is no guarantee of being able to incubate genuine innovation.

Forget earnings as the basis for these sorts of valuations – with Jet.com there weren’t any. Instead Wal-Mart are backing the Jet.com management to help put a dent in Amazon’s dominance in the online arena.

Lore, apart from pocketing a huge de-risk, has landed the job of heading up Wal-Mart.com as well as running the Jet.com brand separately.

Never before has IP and innovation been in such demand so early in the business life cycle by larger corporates who are at last valuing businesses not just by the IP, but the management teams who created it!

We are increasingly seeing larger acquirers considering businesses they previously would have ruled out simply based on size. It’s therefore never too early to consider selling or merging.

We expect much more of this kind of match up in the years to come as technology continues to level the playing field in favour of the smaller guys.

Reference:

Australian Financial Review ‘Wal-Mart pays record $US3.3b for e-commerce Jet.com‘ 10/08/16