- 19 March 2020

- Michael McGrath

First Rule of the game is #StayInTheGame.

As I write this on Sunday lunchtime, 15th March, things are moving fast. I spent most of the weekend trying to be useful by talking with our clients about the evolving situation with COVID-19 and the various responses that might be necessary.

I don’t envy any politician landed with this on their watch. In Australia, the plan appears to be to limit the rapidity of infections, ‘extending the curve’ in order to reduce the impact on our health infrastructure so that as many people as possible get the help they need once infected.

That’s clearly their priority and who could argue with that? Not me anyway.

Uncertain Times

The statistics about the percentages of who will be infected and who will get sick and who may die vary significantly. We have no view on these matters as they are way above our pay grade as Corporate Advisors.

We do however offer those directly affected, both patients, health care professionals and political leaders, our thoughts and prayers.

Health Crisis or Economic Crisis?

The penny dropped for me on Thursday night listening to the UK government briefings – Australia and the UK look to be at similar stages right now in this evolving crisis.

Supply side issues have become apparent over the past few weeks as a result of some heightened demand – but until now it’s appeared manageable.

The consequences have since become apparent, that while the goal of ‘extending the curve’ will ease the burden on our healthcare systems, the unintended impact is that business and the economy will pay a very high price for that decision.

Inevitably, the demand for products and services will universally soften (there will be a few winners, but not many) and depending on the sector and the specific dynamics some business may see revenues go to zero.

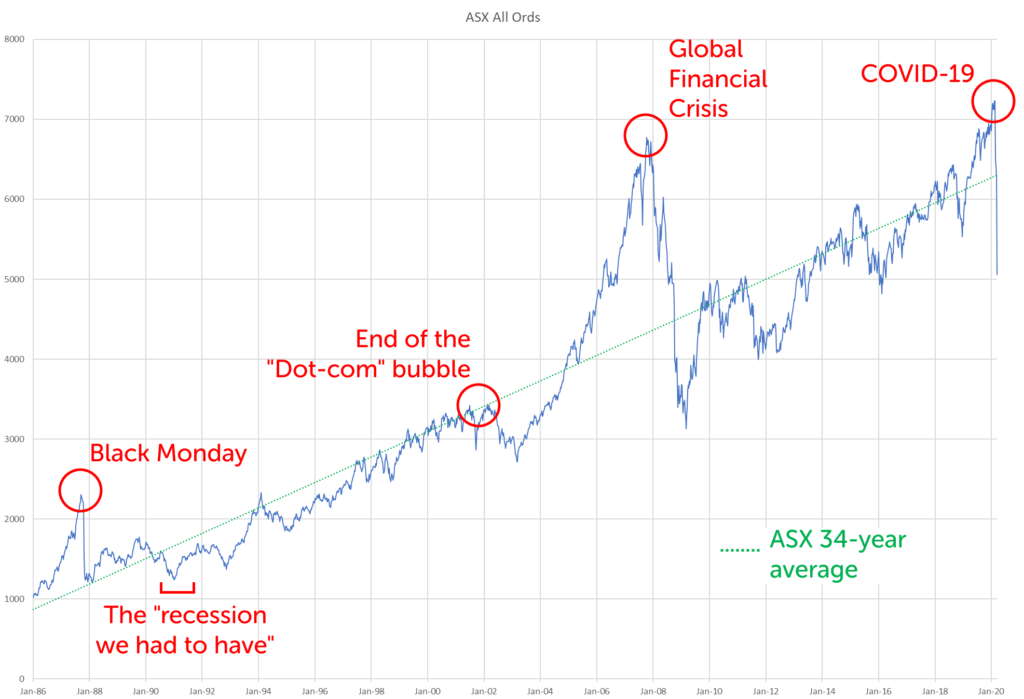

What history tells us

Normally we can look back to other periods of economic crisis for clues as to what might happen next.

There was of course the 1990 Australian recession when unemployment was high (over 10%), and then the GFC where Australia managed to dodge a very large bullet.

But this is different to anything in my 35 years in business. We may have to go much further back for clues.

The Spanish flu in 1918 and the depression of the 1930s may offer some rather insightful – if depressing – insights.

The Impacts

Whilst I am not clear on how long the impact of this might affect us economically, or how deep this upcoming recession will be, I have no doubt that we are rapidly moving to a new paradigm where liquidity and survival will be the main game irrespective of the business size.

You may have noted that Flight Centre shut 100 of its stores last Friday and that Qantas have grounded a large portion of its fleet and have stood down 70% of their workforce.

If you are the owner of a small to medium sized enterprise, do not, I repeat, do not, just wait to see what happens next.

Treading wisely

As leaders, your stakeholders want, need and deserve leadership. No matter what your circumstances, if you are not already doing this then we think you must take the action immediately.

Please note here that we are assuming you already have a plan to minimise infection and know what to do if you or staff show symptoms. This needs to be based upon the latest up-to-date advice provided by State and Federal agencies. The following is commercial input aimed at dealing with the health or otherwise of your company.

Your COVID-19 Action Business Action Plan

Step 1: Pull together the leadership group and/or your external advisors or just sit down with a spreadsheet and take a view on what might happen to your revenues over the next 6-9 months.

This sounds difficult in such a chaotic and unfolding situation however this is why you get the big bucks! This is your watch. It won’t be easy but the alternative (the Ostrich plan) isn’t helpful at all.

Determine two or three options (best case, expected and worst case). Look at your individual clients, your revenue concentration, and find some data points to help you.

For example: On Saturday I asked a CEO to research what happens to Chocolate sales in a recession. Will this be accurate? Probably not, but it’s something to start with.

80% of your view needs to be driven by data and logic, only then do you apply your instincts to the last 20%.

Once you have done that you will have formed a current view on what might happen to the demand side.

You will then have a likely gross profit (GP) from which you can plan what to do next (cash left after paying all your direct costs of delivery, the GP is what’s available to pay your overheads).

Obviously, in determining your likely demand you must have taken any issues on the supply side into account (shortages of stock etc).

Step 2: Now start the difficult task, through a simulation exercise, of attempting to right size the business by looking at your cost-down options.

The severity of this will be driven by two things, your view of how soft revenues will be over time and your cash reserves and the ability to borrow.

This is unprecedented in 35 years. I have never had to consider situations that could see possible zero revenues for several months!

In January 1990 our revenues in a pizza home delivery business dipped by 15% and pretty much stayed down for 2 years.

The Coronavirus is a much more volatile set of circumstances than that. Revenues might dip harder here but recover quicker, it’s hard to know.

Step 3: Figure out the trigger points you will use to take the actions you have determined in step 2.

This is vital in allowing you some peace of mind. It might be that you have three versions of cost-down measures from the least severe to the most severe. If your assumptions don’t materialise and revenues stay stronger for longer then you can act proportionately.

All Australian board members are currently in their huddles right now determining a version of these three steps, and if they’re not they should be – so you should get moving.

Now the reality is that most small to medium sized enterprises are delicately balanced, cash is scarce, and liquidity is tight.

You will probably find that steps 2 and 3 will leave you with some pretty severe losses which the business cannot withstand.

This is where you will need to start communicating with your lenders.

Survival of the fittest

A huge part of businesses ability to survive and our economies ability to bounce back will come down to how the banks behave.

They are unpredictable at the best of times. In 1990 they were awful, however during the GFC in Australia we found them acting surprisingly sensibly.

Politicians will have some limited ability to try and set the tone but we, as owners and advisors, have a huge responsibility to communicate professionally and logically setting out the story/position in a manner that reassures our lenders that we are a strong management team, have thought out the situation going forward and have a plan worth supporting.

If you are an owner, don’t delay. Don’t get stuck in the headlights of the 24-hour news cycle. Take positive constructive action – do what you can, with what you have from where you are now.

If you need somebody to talk to on these matters by all means call us.

My team are all very experienced professionals who, like me, have come through the school of hard knocks and are hard to scare.

In the meantime, stay safe, stay healthy and just keep taking the next right action.